Everything You Need to Succeed

Contracts

Disclosures

Operating Procedures Forms

Preferred Pro (Bookkeepers, CPAs, Lawyers)

Best Results.

Funding Types We Work With

Unsecured Corporate Credit Cards.

Unsecured Corporate Loans

Unsecured Corporate Lines of Credits

Equipment Financing/Leasing

Auto Financing/Leasing

Real Estate Financing

Here’s How We Can Help You

You Bring the Ideas.

We Bring the Credit.

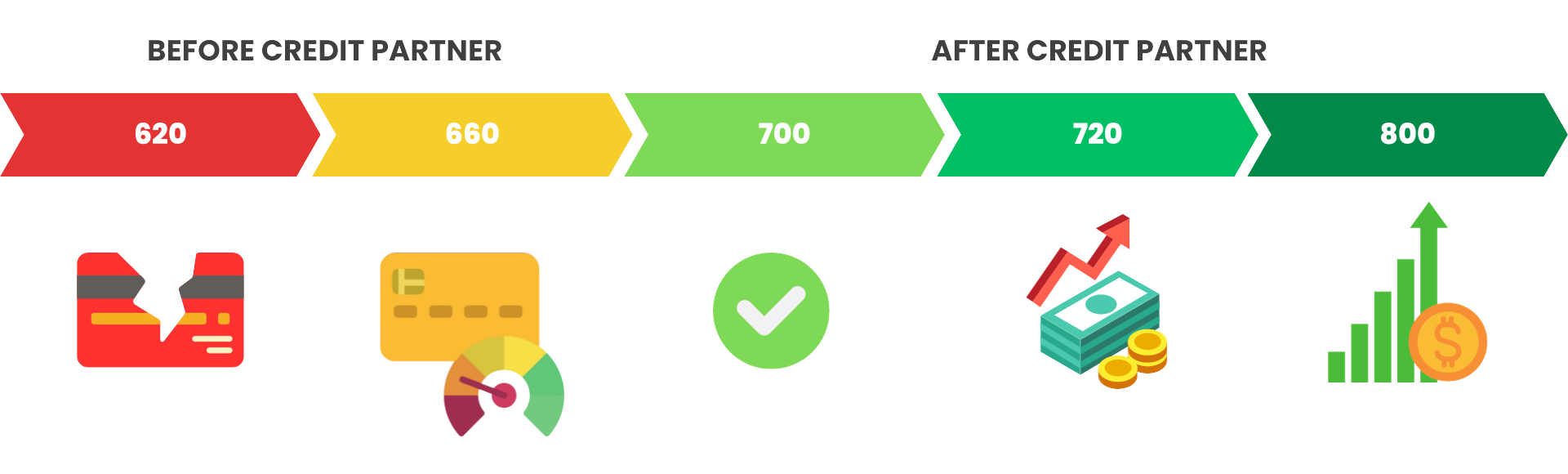

Need a Credit Partner?

We have them

Already have a Credit Partner?

We facilitate the process.

All Contracts, Procedures,

and Systems included.

Business Plan Creation

Assistance

Funding Assistance.

Everything you need to make it work.

Chat on Facebook

Chat on Facebook